Time and time again there is a solution to every problem, challenge, obstacle or anything else that may cause us to fret. Ecclesiastes 3: 1-8. The Affordable Care Act never stated insurer had to do away with the underwriting process. Several elements to sell plans were implemented to conform and to be compliant with the law which included: essential health benefits which are all necessary; with the exception of pediatric dental and vision coverage, especially for someone who does not have minor children in their custody.

The other element is the fact that carriers could no longer deny coverage to consumers who has more than enough health related conditions with exorbitant premiums, terms in the insurance world “rated” because of preexisting conditions.

This is the major problem facing the health sector and why insurers are unable to measure their risk with finding reasonable rates for the American people. This is a shot in the dark for insurance companies to play a guessing game of not knowing who has chronic health problems on a regular basis and what the cost would be to accurately provide care at reasonable prices. Actuaries’ calculate insurance with a purpose; to estimate risk. No measuring stick, no wonder why carriers have lost money over the last several years and are ready to bail out.

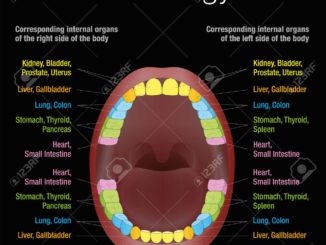

The government involvement in the insurance industry is to govern, not necessarily to run the insurance business. It is sad that large carriers are allowing the government to dictate and rule out the main premise of insurance. This business is built on risk factors. There is no difference if you wanted to purchase homeowners, auto; or any other type of insurance, there are risks with insuring property. Our physical bodies are a higher risk since we are moving objects on the go all the time, we wear out and break down time to time and have to be repaired and healed.

Why aren’t insurers addressing this fact with lawmakers? What are the chances of a mechanical breakdown with stationary buildings? Physical buildings breakdown due to neglect and lack of maintenance, or if someone physically damaged the property for whatever reason. When was the last time you purchased property and casualty insurance and your risk wasn’t taken into consideration for how much you will be charged in premium dollars? Well, it is no different with health insurance.

There is a solution and a plan that will work. It is not about taxes, neither is it about how many people will lose coverage, cutting back on Medicaid, squeezing the poor, the rich getting richer or the other non sense we hear from politicians. Insurers need to be bold and follow the guidelines of the current law, go back to the underwriting process, deny no one coverage and have affordable premiums based on risk the way it was in time past; prior-Affordable Care Act.

As consumers, it is our responsibility to take care of these earthly bodies and to protect our finances while we are physically and financially able to do so. Are you going to wait after a chronic health condition comes over you and then attempt to get coverage? That’s like having a building already on fire, and then calling an insurer to get covered. Be wise, get yourself the protection you need while you are still insurable before your temple begins to deteriorates.

Proudly WWW.PONIREVO.COM

Source by Clark A. Thomas