When people can participate in the financial systems, they are better able to start and expand businesses, invest in their children’s education, and absorb financial shocks.

Sub-Saharan Africa has a population with most lives being at the economic downstream, and most likely underdeveloped. The financial inclusion gender gap and income gap persisting just like in other continents, though higher in Sub-Saharan Africa. World Population estimates based on the latest estimates released on June 21, 2017, by the United Nations, shows Africa continues as the second largest continent with a population of 1,256,268,025 (16% of the population of the world) and by the end of January 2018, 40.2% living in urban areas.

The continent has the highest fertility rate of 4.7% (Oceania 2.4%, Asia 2.2%, Latin American and Caribbean 2.1%, Northern America 1.9% and Europe 1.6%) compared to the other continents with a yearly population rate change (increase) of 2.55% – the highest among all continents. Most of its people (59.8%) have lived downstream (rural areas and villages) sometimes out of the mainstream economy. Policy targeting could be difficult in such scenarios, and identifying people who lack access to financial and economic inclusion comes with a huge financial cost in itself, though the benefit in doing so outweighs the cost in mere numbers and requires commitment from leaders and managers of the respective economies. Coupled with a universal phenomenon of non-perfect, untrusted, and in some cases non-existing data on the continent, that could make decision making imperfect and data unreliable, affecting plans, policies and the potencies to resolve stated challenges or improving the economic and social fibre of countries.

The struggles of the financially excluded come from barriers and reasons as access, social and cultural factors, income, education and many possible lists of others. Financial exclusion arguably is one of the reasons some economic policies lack potency to effectively target well on the citizenry with its results in persistent poverty and inequality. Lack of access to basic needs like an account either at the bank or mobile money could mean significant possibilities of opportunities untapped. Globally countries have realized the importance of achieving inclusive societies and supports efforts at maximizing financial inclusion. Sub- Saharan Africa has made some strides over the years in financial and economic inclusion in this regard at individual country levels.

Efforts ongoing in Ghana include a commitment to promoting and prioritizing financial inclusion. The country made specific and concrete commitments to further advance financial inclusion under the “Maya Declaration“ since 2012 and has an ambitious target of achieving 75% Universal financial inclusiveness of its adult population by 2020. Ghana currently has 58% of its adult population having access to financial services and is also finalizing its National Financial Inclusion Strategy which will become the guiding document and reference for inclusive actions, stakeholder roles and responsibilities spelt out for all.

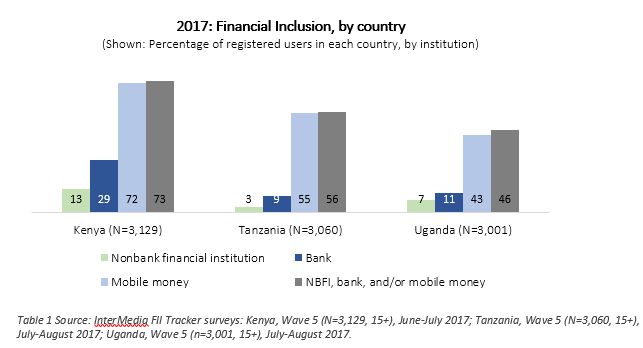

Kenya, however, has earned global recognition in leading the all others in the world in mobile money account penetration, and with twelve other sub-Saharan African Countries following, researchers show. The rate at which African countries are projecting innovation technology for digital financial inclusion is impressive. The country has made giant strides in its financial inclusion commitments, especially under the Maya Declaration.

There has been some paradigm shift in Information and Communication Technology and its importance which is being considered as a factor of economic growth. ICT has the ability to provide services with minimal cost, improve innovation, and provide infrastructure for convenient and easy to use services, it can also provide a route to access many auxiliary financial services.

At the macro level, digital innovation influence economic development and economic policy effectiveness.The benefits ICT enabled financial services include the possible creation of employment- mobile money vendors, increases in revenue receipts of government, helps firms productivity (both private and public), aid in cost control and efficiencies, and Could contribute to rural development and governance: Governance and revenue mobilization efforts, especially at local government levels, can be enhanced through ICT which aids in overall improvement in corporate governance. Importantly, Innovation Technology can help in the deepening of financial inclusion either through access, usage, reducing risk and improving quality of services, thus, per formula for Financial Inclusion (FI), thus, FI = (Unlocking Access + Unlocking Usage + Quality) – Risk.

Access to financial services can generate economic activities-Sophisticated use of financial services even presents bigger economic and social possibilities for the included. In Mexico, a research by Bruhn and Love revealed that, there were huge impacts in the economy in Mexico, that is, 7% increase in all income levels (in the local community) when Banco Azteca had rapid openings of branches in over a thousand Grupo Elektra retail stores when compared to other communities that branches were not opened. Also the savings proportion by those households in the local community reduced by 6.6%, a situation attributed to the fact that households were able to rely less on savings as a buffer against income fluctuation when formal credit became available.

Here, it must be noted that through savings is encouraged, the reduction in savings by 6.6% means more funds can rather be channeled for investments into economically viable entities or services. As the cycle continues, and in sophisticated use of financial services along the financial services value chain, they will need to save however for other investments later. Similar or even more positive correlation is observed if the medium of access and usage is through innovative technology.

Using Digital Financial Inclusion Strategies in Humanitarian Services

Despite the use and usefulness of financial services in crises situations, financial exclusion is particularly acute among crisis-affected countries. 75% of adults living in countries with humanitarian crises remains outside of the formal financial system and struggle to respond to shocks and emergencies, build up productive assets, and invest in health, education, and business.

Researchers continue to show the growth in acceptance of electronic payments especially through the use of mobile phones. There is growing evidence supporting digital financial inclusion. GSMA in its reports revealed that there were 93 countries between the periods of 2006-2016 of with 271 mobile money operating service providers which had registered over 400 million accounts globally. They give some evidence in some countries – which have been receiving humanitarian assistance- where there is growing acceptance of digital financial inclusion through use of a phone.

In Rwanda significant numbers of refugees used phones for mobile money services whiles some do so commercially for service fees. In Uganda, Refugee communities are noted for use of mobile money service as per the report. This has necessitated MNO Orange Uganda, a telecommunication firm to expand mobile money service to refugee communities by building a communication tower to improve access and usage of the services. In Pakistan, one of the largest refugee communities- third largest- has the government using mobile money for cash transfers to refugees. The evidence abounds and this calls for humanitarian agencies to rethink and reconsider digital inclusive financial services beyond the current numbers. In Lebanon (The largest refugee community) those on humanitarian assistance uses ATM issued by aid organizations to access their cash transfers.

Sarah Bailey, however, observed that humanitarian areas that were receiving cash transfers through mobile money could increase the use of certain services but does not automatically lead to widespread or sustained uptake. People may prefer to continue using informal financial systems that are more familiar, accessible and profitable. Her study revealed that that, the provision of humanitarian e-transfers, even when combined with training, was not sufficient to enable the vast majority of participants to conduct mobile money transactions independently.

The findings are certainly acceptable in the short run per our knowledge. However, on a long-term basis and with financial capability activities – not just training- the results could possibly be different. Financial capability activities deal with not just training and education, but the overall financial health and well-being of the people. And this should be done in a hierarchy- bits-by-bits- and not at a one leap jump approach. This seems to have been echoed by the United Nations. According to Ban Ki-moon as cited in advised that we must return our focus to the people at the centre of these crises, moving beyond short-term, supply-driven response efforts towards demand-driven outcomes that reduce need and vulnerability. Financial inclusion strategies may not lead to widespread uptake within a few days, but evidence abounds that in a long-term, it could.

The thirteen countries in the world with the most mobile money penetration today had some being on humanitarian support just a few years back-. Sustained access and use of innovative technology for inclusion then would have a better impact on them the more today.

Undertaking a case study on the use of digital means for humanitarian transfer will show that in the short term run there may be lack of interest or even rejection. Coupled with regulatory barriers and other barriers mentioned, people during a humanitarian crisis may not really be thinking much of connecting to the economic system on the whole or how their support comes (This is the business of policymakers on humanitarian service) but rather be much interested in survival within a short run. The psychology of that period of need is centred on – What is needed is the urgency of support – money – physical cash in most cases to enable them to get the basics of security and food with the most liquid instrument. Humanitarian communities have needs just as all other communities within the financial services need a framework.

Indeed evidence suggests there have been few instances only worldwide where the use of digital transfers in humanitarian transfers has led to widespread use of services. Digital transfers in humanitarian services must be a process and done within the particular context of time. In this sense, the digital strategies must be humanitarian, and must embed in the social and behavioural change financial capability activities capable of two-way communications with practices on usage and the benefits it brings in the long term- It must be in a hierarchy. Simple financial needs should be met before sophisticated needs. Any deviation will of course results in lack of interest in the services.

Howard Thomas observed that “Financial technology still leaves out swathes of people, and this means missed opportunities for development,” And in some cases, community structures may not be innovative or agile enough to allow new technologies to spread, he adds. “Savvy entrepreneurs are not necessarily from established authorities. Sometimes it’s a matter of identifying individual leaders, networks or pathways through which to promote new technologies.”

Indeed there have been some lessons however on how to manage humanitarian remittance, the parameters, however, are that financial inclusion is a continuous and sustaining effort of providing access and usage of financial services in a sustaining and responsible manner which meets the needs within a reduced risk – it is not just one time project of implementation policies at speed but rather concentrate on meeting the basic before sophisticated needs. Within a humanitarian certain, a complex multiplicity of issues may serve as barriers to using digital financial services including location and urgent needs; however those barriers when managed within a considerable period and coupled with financial capability activities (the act of complete financial well-being), then favourable results would be achieved.

The use of behavioural change financial capability education, training and practice into humanitarian communication on digital transfers would help in improvement in the uphill acceptance over a period of time. sub-Saharan African countries have been realizing some tremendous gains in the use of innovative technology, and expansion of ICT services and infrastructure on the continent. Its study time past points out those countries on the continent totally made revenues amounting to 5% of Gross Domestic Product (GDP) from telecommunication related services as compared to European countries where revenues from the telecommunication services represented 2.9% of their total GDP.

Sub-Africans Countries need repositioning and further investment in the “digital economy” in order to open up and benefit fully inclusiveness of their economy. Here our interest is in mobile technology and innovation which is the critical avenue that Africa could use mostly in achieving financial inclusion within the short to long term.

Kenya is making giant strides and leading the way in digital innovation for mobile financial services globally. Researchers have shown that sub-Sahara Africa countries are leading the technological innovation drive in the usage of mobile financial services.Kenya and other Sub-Saharan African nations are making the greatest strides in mobile money accounts penetration and with lots of opportunities foreseen. Globally the thirteen countries that mobile account penetration has been over 10 %, all 13 are from Africa -Botswana, Cote d’ivoire, Ghana, Mali, Kenya, Somalia, Rwanda, Namibia, Tanzania, South Africa, Uganda, Zambia and Zimbabwe (ranging from 10%-58% for the 13 countries).

Kenya is leading at 58% mobile money account penetration, with Somalia, Tanzania and Uganda “following closely” reporting around 35%. Namibia out of 13 countries has the least of mobile money penetration of about 10% (still higher than all others in the world except the other 12 African countries). Mobile money account is recorded to be widespread in East Africa (20% and 10% of adults have mobile money accounts and mobile money account only respectively) than any other region.

Firms providing financial services, be it services or infrastructure is the most important and unique set of stakeholders who should be encouraged to take the lead roles in financial inclusion activities and implementations. Financial services firms are uniquely positioned, to use their existing infrastructure and leverage to creating access, and usage of digital financial services.

They do so effectively and at a lesser cost as compared to government agencies because they can do so through their already existing departments as the marketing and customer service departments. Financial services firms are driving innovation for digital finance across the globe. Firms as GCAP have been investing in solutions to accelerate financial inclusion. It announced that in its call for proposals on innovative digital technology with huge potential to advancing the financial inclusion drive in sub-Saharan Africa, out of the over 200 applicants and proposals submitted, Financial Technology (Fintech) firms submitted (56%), Financial Services Providers (18%), Non-Governmental Organizations (NGOs) (13%) and Technology Services Providers (9%).

Growing evidence from other similar calls suggests that there is a trend, that the journey of using innovative technology and financial inclusion in the sub-Saharan African is not only picking up but even shows a rather promising outlook for the future, the opportunities for countries in the region are enormous for nations in advancing financial inclusion.

The call now is for countries at their policy levels to position themselves, armed with policies and willingness of governments to support and collaborate with the private sector to drive financial inclusion activities. However, to further enhance financial and economic for much better gain is a continues process and does not take just a few days but undoubtedly without collaborations between public-private role and decision establishment and support, it will take us rather too long. Collaboration is therefore important for financial inclusion drives and actions.

For governments or the public sector, their support in creating the needed supportive framework and regulations for the industry is important. Regulations and environment that supports innovation and drives whiles customer rights are supported are so much needed in this sector. In providing support and helping in creating an environment for financial inclusion activities to make the required impacting effects, government policies must have some balance of care. By doing so, any policy by a government on financial inclusion that does not take views from other important stakeholders may be implemented at last, but not without difficulties and in some case unreasonable delay in implementation.

This can be attributed to a variety of reasons: more importantly, policies may be concluded, but if Financial services providers are not ready or not able to implement those policies, then, problems of “distressed“ policies then begin to show. In financial inclusion drives, success depends mostly on collaborations for improvement between the public-private sectors.

The Opportunities for sub-Saharan African Economies

The opportunities exist for groups of people who need access and usage of financial services yet unable because of the barriers they confront mostly. Sub-Saharan African governments and private stakeholders can improve on the regulatory constraints and allow for the tap in technology innovation respectively to design solutions that will open access and usage of financial services

An important Segment of organized groups usually out of the formal financial economy thus, the “Savings Groups” always have their common values and beliefs most often deeply rooted with cultural and social entrenchment that must be considered when targeting with financial inclusion products and designs.

The groups usually common in Asia, sub-Saharan Africa and Latin American come together for social and economic benefits and supports. They have different specific objectives but commonly among reasons are for group savings, group insurance, good trading and all kinds of group support systems. At best design of product and services for “savings groups” if the top is successfully accepted can only be through a consultative process, sometimes customized or tailor-made services (most appropriate where possible) and winning the genuine interest of the groups.

There are over 14 million members of “Savings Groups” across 75 countries in sub-Saharan Africa, Asia and Latin America, representing a promising platform for financial inclusion in under-served markets. Savings Groups offer an entry point for financial service providers to isolated communities; they are organized, experience and disciplined; they aggregate demand across many low-income clients, and they have identified needs that financial service providers can address. Also, these groups are very goal oriented and purposeful but lack certain financial services- Some basic needs like accounts and payments and others sophisticated needs like saving platforms. Tailoring products to meet these segments who lack access to some financial services and are in need of those financial services would create opportunities for financial inclusiveness.

Prioritization of digital payments is one way of minimizing corruption within expenditures, be it the private or public sector. Digitizing payments means better tracking of records of payments throughout the value chain of spending and transfers. In the Agriculture economy, it means that when the government pays 1 million dollars ($1.000.000.00) directly through “mobile money` to its citizenry for goods and services, then its most likely that, subject to cost of the transaction, farmers will receive their funds intact and same. The vulnerable citizen would then have value for money in dealing with the government whiles having to benefit from the opportunities that having an account and using it comes with. Such is not the case when physical cash changes hands in payments.

The adoption level of digital financial inclusion with mobile money is generally high for sub-Saharan African. Stakeholders in the Public in the region can leverage its strong foundation and application of mobile money services to scale up the use of digital payments, but courses they must be the backing infrastructure to expand access as well. Increase in account ownership as a foremost financial inclusion indicator has primarily been through financial institutions except those recorded in Africa where mobile money accounts drove the growth in accounts ownership from 24% to 34% in 2011 and 2014 respectively.

An area Africa is making giant strides – Mobile money account penetration. Accounts ownership and its definition have changed over just three years when Global Findex Database launched its first data for comparable indicators among countries on financial inclusion. In 2014 it considered mobile money accounts as recognized accounts in their right, hitherto in 2011 that wasn’t the case. The opposite was rather the accepted case, and rightly so. Today the digital disruptions in the financial, telecommunication and economic arena are having is impacts.

For policymakers and private sector stakeholders, more keenly important is the fact that 5 of the thirteen sub-Saharan African countries (The only five in the world) – Somalia, Uganda, Côte d’Ivoire, Tanzania and Zimbabwe have an adult population with more mobile account than they have from a formal traditional financial institution. What this means is that, in those five countries, an ordinary man on the street is more likely to have, use, trust and save in a mobile money account or wallet than saving with a traditional formal bank account. This comes with enormous opportunities and breakthroughs. Digital payments are comfortable, fast and less expensive than physical cash payments platforms.

Tailoring products to meet these segments who lack access to some financial services and are in need of those financial services would create opportunities for financial inclusiveness. Prioritization of digital payments is one way of minimizing corruption within expenditures, be it the private or public sector. Digitizing payments means better tracking of records of payments throughout the value chain of spending and transfers. In the Agriculture economy, it means that when the government pays 1 million dollars ($1.000.000.00) directly through “mobile money` to its citizenry for goods and services, then its most likely that, subject to cost of the transaction, farmers will receive their funds intact and same. The vulnerable citizen would then have value for money in dealing with the government whiles having to benefit from the opportunities that having an account and using it comes with. Such is not the case when physical cash changes hands in payments

The adoption level of digital financial inclusion with mobile money is generally high for sub-Saharan African. Stakeholders in the Public in the region can leverage its strong foundation and application of mobile money services to scale up the use of digital payments, but courses they must be the backing infrastructure to expand access as well. Increase in account ownership as a foremost financial inclusion indicator has primarily been through financial institutions except those recorded in Africa where mobile money accounts drove the growth in accounts ownership from 24% to 34% in 2011 and 2014 respectively.

An area Africa is making giant strides – Mobile money account penetration. Accounts ownership and its definition have changed over just three years when Global Findex Database launched its first data for comparable indicators among countries on financial inclusion. In 2014 it considered mobile money accounts as recognized accounts in their right, hitherto in 2011 that wasn’t the case. The opposite was rather the accepted case, and rightly so.

Today the digital disruptions in the financial, telecommunication and economic arena are having is impacts. For policymakers and private sector stakeholders, more keenly important is the fact that 5 of the thirteen sub-Saharan African countries (The only five in the world) – Somalia, Uganda, Côte d’Ivoire, Tanzania and Zimbabwe have an adult population with more mobile account than they have from a formal traditional financial institution. What this means is that, in those five countries, an ordinary man on the street is more likely to have, use, trust and save in a mobile money account or wallet than saving with a traditional formal bank account. This comes with enormous opportunities and breakthroughs. Digital payments are comfortable, fast and less expensive than physical cash payments

Recommendations

1) Regional and sub-regional bodies in sub-Saharan Africa should take up the financial inclusion drive as a priority and ensure peer-to-peer commitments of its members based on individual country socio-economic dynamics.

2) Each sub-Saharan African country should develop a National Financial Inclusion Strategy in a highly consultative manner at their country levels to guide their efforts.

3) Sub-Saharan African governments should continuously support ongoing literature and research work on Financial and Economic inclusion to provide reliable data will guide the policymakers developmental aspirations and economic policies. Therefore countries should set up Financial Inclusion Research Fund as part of their National Financial Inclusion Strategy to support continues research on financial inclusion issues for their jurisdiction.

4) Sub-Saharan African Countries should commit a percentage (at least 1%) of their annual GDP as the budget for Innovative technology for the support of the digital economy stimulus for sectors like financial service and other industries to perform.

5) Efforts should be made at country and regional levels to make the use of financial services delivered electronically cheaper – best practice is Wechat and AliPay payment solutions in China. Wechat specifically has no cost build up for use of its platform for payment of goods and services, therefore promoting the use of mobile phones and users can transfer cash and make purchases digitally for goods costing as low as half a dollar. It is practically possible to pay for an item bought at an amount which is less than a dollar with no additional fee except the cost of item only. These are some of the readily felt benefits of Innovation Technology within the banking space.

6) African government set up support investment funds and partner firms which can design innovative technologies in the area.

Proudly WWW.PONIREVO.COM