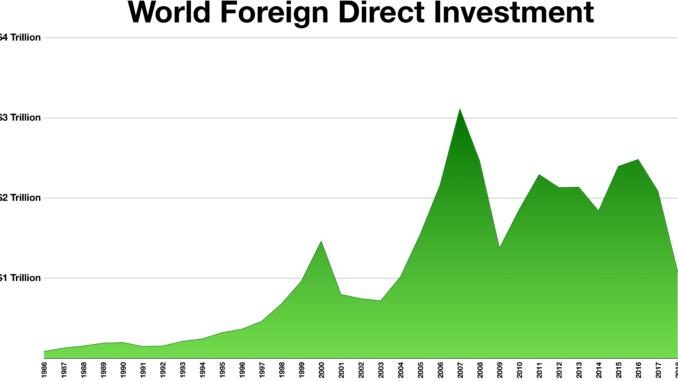

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from foreign portfolio investment by a notion of direct control. In foreign portfolio investments an investor merely purchases equities of foreign-based companies.

Broadly, foreign direct investment includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations and intra company loans”. In a narrow sense, foreign direct investment refers just to building new facility, a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. FDI is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. FDI usually involves participation in management, joint-venture, transfer of technology and expertise. Stock of FDI is the net (i.e. outward FDI minus inward FDI) cumulative FDI for any given period. Direct investment excludes investment through purchase of shares.

Who can be a Foreign Investor?

A foreign direct investor may be classified in any sector of the economy and could be any one of the following:

- An individual;

- A group of related individuals;

- An incorporated or unincorporated entity;

- A public company or private company;

- A group of related enterprises;

- A government body;

- An estate (law), trust or other societal organization; or

- Any combination of the above.

How can a Foreign Investor invest his funds?

The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods:

- By incorporating a wholly owned subsidiary or company anywhere.

- By acquiring shares in an associated enterprise.

- Through a merger or an acquisition of an unrelated enterprise.

- Participating in an equity joint venture with another investor or enterprise.

FDI incentives:

Foreign direct investment incentives may take the following forms:

- low corporate tax and individual income tax rates

- tax holidays

- other types of tax concessions

- preferential tariffs

- special economic zones

- EPZ – Export Processing Zones

- Bonded warehouses

- Maquiladoras

- investment financial subsidies

- free land or land subsidies

- relocation & expatriation

- infrastructure subsidies

- R&D support

- Energy

- derogation from regulations (usually for very large projects)

- by excluding the internal investment to get a profited downstream.

Corporate Structures:

Various Corporate structures are available for setting up a place of business. There are three (03) ways, whereby, a foreign company may have its presence in the country:

- Liaison Office;

- Branch Office; and

- Locally incorporated subsidiary

Security of Foreign Investment:

Legislative Protection: Several laws provide protection to foreign investors/investment.

Bilateral Investment Treaties (BITs): Bilateral Agreements on Promotion and Protection of Investment (46 countries) provide the following:

- The Contracting Parties shall encourage investments in their respective territories by investors of the other Contracting Parties.

- Non-discrimination between local investors and foreign investors.

- Equal/non-discriminatory treatment in case of compensation for losses owing to war, other armed conflicts or a state of national emergency.

- Free transfer of investments, and income deriving therefrom including profits, dividends, interest income, proceeds of sales or liquidation, repayments of loans, salaries, wages and other compensation, etc.

- A dispute settlement mechanism to settle any dispute between the countries with respect to the interpretation of the respective agreement and a dispute settlement procedure to settle any dispute between a host country and an investor of the other country.

Unless otherwise stated, PONIREVO and/or its licensors DO NOT own any intellectual property rights in the website and material on the website. Majority of the site’s content has been scraped and auto posted by a third party artificial intelligence program —– PONIREVO Creation Team.

Proudly WWW.PONIREVO.COM