Investors often ask me to show them only the best commercial properties. This requirement is at least not clear or specific enough for this advisor. A best property for one investor may not be suitable for another investor. This is because each investor has different set of investment objectives. You should at least consider the following:

- Investment returns: when you deposit your money in CDs, you get 1.5% interest for 6- month CDs, so what kind of return, i.e. cap rate is acceptable to you when you invest in commercial real estate? The current cap rate in 2009 varies between 5% to 12% depending the property type, property condition, location, and various other factors. Properties in California tend to have lower cap than those outside of California due to higher demand.

-

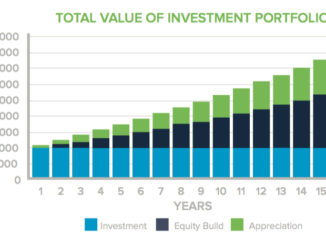

Appreciation: one of the benefits in real estate investments is its potential for appreciation. However, this potential also varies from one property to another. There are several factors that impact appreciation. Some you have little control, e.g. demand and supply. However, you know the demand is weak and supplies are abundant in declining rust-belt areas, e.g. Detroit. And thus the properties in these areas will not likely to appreciate. Some you have control, e.g. rents or net operating income of the property. So if appreciation is important to you, focus on properties with

- Below market rents. When the leases expire, the rent will be adjusted to higher market rents. As a result, the value will likely go up. Sometimes a tenant may pay 10-25% below market rent because the landlord does not know how to get the highest rents for his property. It’s not easy to determine by yourself if the rent is below market so you may need a professional to help you

- Annual rent bump located in stable or growing areas with high barriers for entry. When the rent increases, the operating income increases; and the property is likely to appreciate in value. You can review the rent roll to see if there are any rent increases. It’s very common that the rent goes up 2-3% annually on multi-tenant shopping centers.

- Investment risks: there are risks associated with almost any investments. For commercial properties, one may have higher risks than another. Walgreens should do well during the recession. In addition, it also has very strong A+ S&P rating and so it should be able and willing to pay the rent on time. On the other hand, single-tenant car dealers selling big-ticket items may not fare well during tough economic times and so your rent checks may not come. Of course, there are other properties in which risks are somewhere in between Walgreens and Car dealers, e.g. multi-tenant strip malls. Life also throws a curved ball at you as risks also vary from times to times. Properties occupied by banks, e.g. Wamu were once considered very safe investments a very few years ago until many banks closed down due to subprime problems.

Investment risks and returns tend to go in opposite directions. In general, the lower the risk the lower the returns but there are also moderately low-risk properties offering high returns. They are called good buys. You may need a professional to help identify these. So should you choose a bullet-proof safe investment over moderate risk properties? Imagine that you work for a company that does not give you a raise in 30 years. It however offers a lifetime employment and consistently pays you a modest salary each month. Will you be a happy employee? If your answer is yes because you don’t ever want to be unemployed in your life then you will consider investing in Walgreens or Autozone. Their rent is often flat for 15 to 30 years and the cap rate is modest–in the 6.5% to 7.5% and so the investment returns are low. On the other hand, you know money does not bring happiness but you need more money for shopping which is proven to make you happy. In that case you will need to endure a reasonable dose of risk. Sit-down restaurants in which business is moderated affected by the recession tend to offer higher returns–8% to 11% cap.

To minimize or reduce the risks of your investment, you should

- Choose a property at a great irreplaceable location Tenants will come and go but location does not change. Want to know how important a great location is to a business? A lousy business will be successful at a great location while a good business will fail at a bad location. It’s that important! That’s why some restaurants are still crowded during the recessions. If your property is at a great location, you will likely receive your rent checks on time and regularly.

- Invest in multi-tenant properties. When one tenant vacates your property you will only lose a portion of the total income.

As an investor you need to do soul searching and determine the amount of risks that you feel comfortable with. On top of that, you also have different expectation regarding investment returns and appreciation. All these factors will determine what properties that you would consider. And now you know why there is no single best property for all investors.

Unless otherwise stated, PONIREVO and/or its licensors DO NOT own any intellectual property rights in the website and material on the website. Majority of the site’s content has been scraped and auto posted by a third party artificial intelligence program —– PONIREVO Creation Team.

Proudly WWW.PONIREVO.COM