There are many emotional factors connected with the ownership of Real Estate. Do the historical returns on Real Estate investments justify the confidence so many investors have in them?

The ownership of land has been something that has been rooted deep in the minds of man. Land is seen as the one investment that is solid and permanent. The American Dream has long included the ownership of your own home, but when you move beyond this natural impulse to own property that you can call yours and look at Real Estate purely from an investment opportunity, how does the picture change? Have the historical returns on Real Estate Investment measured up to the confidence it has received.

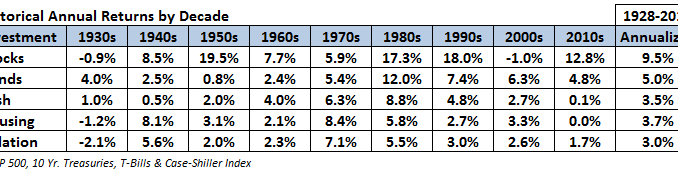

The answer is a cautious yes. Between 1926 and 1996, the annual average rate of return on Real Estate was 11.1%. During the same period the rate of inflation was around 3%. So, it was obviously a better investment to buy Real Estate than to bury cash in jars in your backyard. However, the rate of return for small stocks checked in a bit higher at around 12% while the Dow Jones Industrial Average was a bit lower at 10%. These figures would suggest that Real Estate investments were right there at a par with Stock Market Investments.

Real Estate Investors might want to make the claim that land ownership and its value as an investment predates the Stock Market by thousands of years. They will point to the role that the ownership of land played in the Middle Ages in determining wealth and even nobility. This is true, of course, but in many ways irrelevant to a discussion of the historical returns on Real Estate investments. The new global economy has created a whole new playing field and return of investment must be determined within the scope of this. It is all well and good to study the past to get clues to the future, but in investment the past only offers clues and not answers.

A look at the historical rates of return on Real Estate investments shows that they tend to be more stable and less likely to spike up and down in erratic and unpredictable fashion like the Stock Market. Many investment advisors suggest all portfolios have at least 10% invested in Real Estate for a hedge against market fluctuations. On the other hand, Real Estate investments tend to have high transaction costs and to be in larger units. All properties are unique and each has its own characteristics and potential.

These negative factors have led to the popularity of investments in Real Estate through REITs which are Real Estate Investment Trusts. REITs are a sort of mutual fund of Real Estate which gives investors a way to invest in Real Estate without the problems of high transaction costs or property uniqueness. If you are considering Real Estate investment, either on an individual basis or through a REIT, the historical record should give you some confidence. As much as past performance can reassure us of future success, Real Estate’s past has indicated that it is a safe, sound, and high return investment.

Unless otherwise stated, PONIREVO and/or its licensors DO NOT own any intellectual property rights in the website and material on the website. Majority of the site’s content has been scraped and auto posted by a third party artificial intelligence program —– PONIREVO Creation Team.

Proudly WWW.PONIREVO.COM

by Raynor James